Student loan forgiveness

October 4, 2022

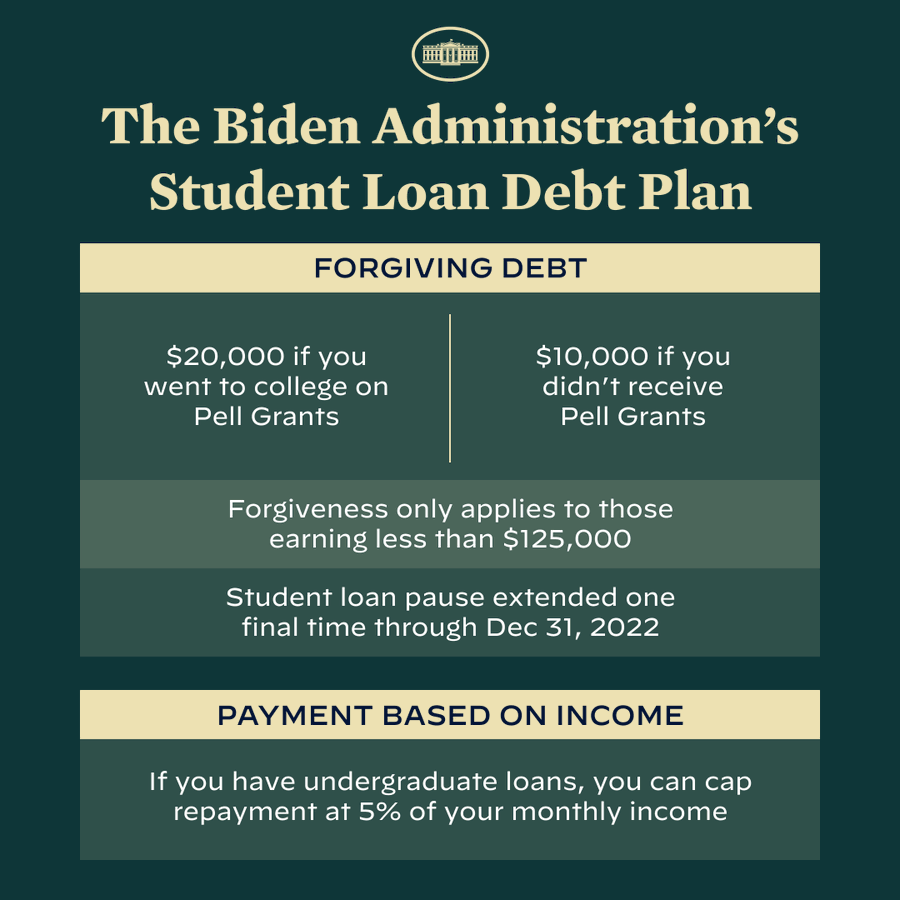

On Aug. 24, the White House released a series of statements regarding student loan forgiveness, which stated a new set of plans for relieving the debt on students both past and present.

The reasoning behind these decisions comes from the fact that American students are paying more now than ever before, as Pell Grants and various other awards continue to become less and less effective at mitigating student debt.

In 2021, President Joe Biden signed the American Rescue Plan, which was a COVID-19 stimulus package that also happened to include approximately $40 billion in relief for various colleges to largely pass onto students as emergency student financial aid.

It appears that $20,000 will be granted to those whose families make less than $125,000 a year (or $250,000 for married couples) and who have been granted a Pell Grant. According to the White House, nearly every Pell Grant recipient (93% as of 2019-20) came from a family making less than $60,000 a year. Everyone else who still meets the above requirements but who did not receive a Pell Grant will be awarded $10,000. There does not appear to be any scaling or compensation curve between the two fixed values either, thus opening the system to potential abuse or harassment (via riding the edge of the cutoff).

Despite the potential shortcomings of the distribution system, the provided aid will certainly be of use to many students past and present. The majority of which continue to struggle with ever-increasing student debt bills as time drags on.